About Liquid Fund

Fund Type

Vintage: 2023

Fund Size: $24.5m

Ecosystem Specialization

The liquid fund primarily engages with major crypto ecosystems such as Bitcoin, Ethereum, and leading DeFi and layer-1 networks. By focusing on established assets and high-liquidity markets, the fund positions itself to capitalize on key market trends and emerging opportunities.

Investment Philosophy

The liquid fund aims to identify digital assets with strong potential for both short-term gains and long-term growth. We focus on market leaders and emerging opportunities, applying disciplined trading and portfolio management to navigate volatility and deliver superior returns.

Performance and Track Record

Since launching in 2023, the Liquid Fund has delivered a cumulative return of over 447% across three years. It returned 212% in 2023, 200.5% in 2024, and is up 34.3% through April 2025. The fund has shown strong monthly performance, with multiple double-digit gains and limited drawdowns, reflecting consistent execution of its active trading strategy in dynamic market conditions.

Risk Management

Recognizing the inherent volatility of crypto markets, the liquid fund applies strict risk management practices. This includes diversified exposure, disciplined position sizing, and continuous market monitoring to safeguard capital and maintain a stable, high-performing portfolio.

Operational Transparency

Investors receive regular updates on liquid fund performance, trading activities, portfolio adjustments, and market insights. We prioritize clear communication and transparency, ensuring investors stay informed and engaged with the fund's strategy and progress.

Our Competitive Advantage

Trust

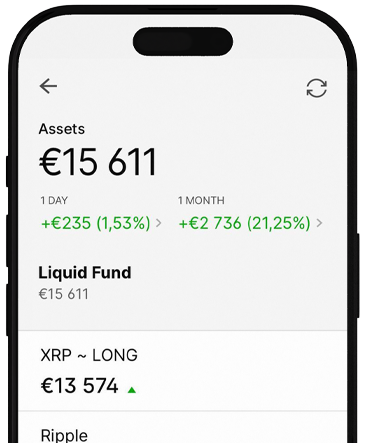

Dashboard

The investment dashboard provides a clear overview of portfolios, allowing investors to track performance, access detailed reports, and receive real-time updates on their investments.