About Fund III

Fund Type

Fund III is a discretionary investment fund designed to advance blockchain innovation by deploying capital across venture equity, early-stage tokens, and liquid digital assets, applying a focused, high-conviction investment strategy to capture early-stage opportunities across the evolving digital asset landscape.

Ecosystem Specialization

While Fund III invests broadly across blockchain, it holds particular interest in projects driving innovation in interoperability, decentralized infrastructure, and next-generation blockchain technologies. Notable focus areas include Ethereum-native protocols, cross-chain platforms, and early AI-integrated blockchain projects.

Investment Philosophy

Fund III seeks to identify and back companies and protocols with the potential to become sector leaders. The fund targets projects in DeFi, infrastructure, payments, gaming, and beyond — aiming to support teams reshaping how value is created, stored, and exchanged in the digital economy.

Performance and Track Record

Fund III builds on Nasu Capital's established success, leveraging its proven network, deep industry expertise, and prior track record of generating significant realized and unrealized profits across multiple blockchain-focused funds, consistently delivering strong investor outcomes.

Risk Management

Recognizing the volatility of blockchain and digital asset markets, Fund III employs a rigorous due diligence process, assessing team quality, technology strength, market positioning, and scalability before each investment, ensuring a disciplined, high-conviction portfolio approach.

Operational Transparency

Fund III provides regular updates to its investors, sharing detailed insights on portfolio performance, new investments, market developments, and fund strategy. This ensures clear communication, accountability, and ongoing engagement with the investor community.

Our Competitive Advantage

Trust

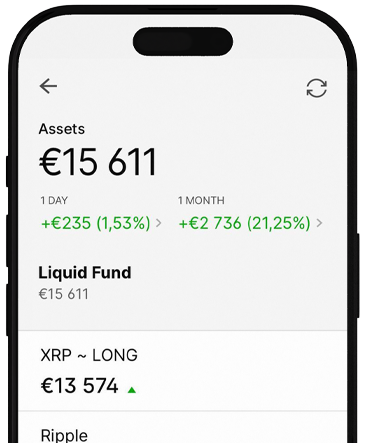

Dashboard

The investment dashboard provides a clear overview of portfolios, allowing investors to track performance, access detailed reports, and receive real-time updates on their investments.

Security

Clients First

Institutional Grade

Freqeuently Asked Questions

What distinguishes Fund III from the previous funds?

Fund III represents our most ambitious strategy, targeting revolutionary blockchain technologies and institutional-grade solutions. It has a larger fund size, expanded investment scope, and enhanced due diligence processes based on lessons learned from our previous successful funds.

What sectors does Fund III focus on?

Fund III targets AI-powered DeFi protocols, next-generation layer-1 networks, institutional infrastructure, cross-chain solutions, Web3 applications, and emerging technologies that will drive the next wave of blockchain adoption and innovation.

How does Fund III support portfolio companies?

Beyond capital investment, Fund III provides strategic guidance, technical expertise, ecosystem connections, and market positioning support. We work closely with portfolio companies to accelerate development, facilitate partnerships, and navigate regulatory landscapes.