About Early-Stage Tokens

Fund Type

Discretionary investment vehicle focused on early-stage tokens with liquidity. Invests in teams developing new protocols, applications, and platforms across emerging blockchain ecosystems. Uses a venture-style model to target innovative, early-stage opportunities.

Ecosystem Specialization

Prioritizes high-potential projects across diverse blockchain networks, seeking scalable solutions and strong community momentum. Selective investments include promising protocols, novel token models, and infrastructure innovations that advance the crypto landscape.

Investment Philosophy

Focuses on identifying tokens with the potential to shape or significantly influence blockchain sectors, including DeFi, gaming, NFTs, and infrastructure. Emphasizes projects pushing innovation and driving adoption within dynamic market environments.

Performance and Track Record

Built on a strategy that capitalizes on the rapid growth potential of early-stage blockchain projects, leveraging technological innovation and engaged developer communities to capture long-term value and portfolio growth.

Risk Management

Applies rigorous due diligence to assess team strength, project viability, market fit, and long-term sustainability. Maintains a disciplined approach to navigating the volatility inherent in early-stage crypto investments.

Operational Transparency

Provides investors with regular updates on fund performance, new investments, and market insights, ensuring clear communication, transparency, and active engagement with the investor community.

Our Competitive Advantage

Trust

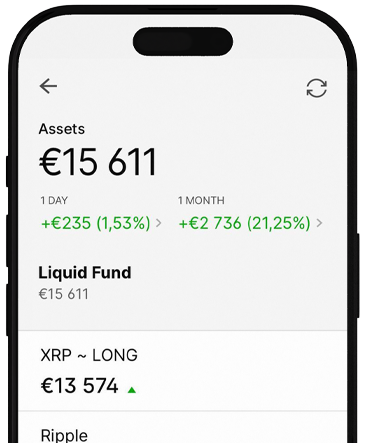

Dashboard

The investment dashboard provides a clear overview of portfolios, allowing investors to track performance, access detailed reports, and receive real-time updates on their investments.

Security

Clients First

Institutional Grade

Freqeuently Asked Questions

What makes early-stage token investments different from established crypto assets?

Early-stage token investments offer higher growth potential but come with increased risk. These projects are typically pre-launch or recently launched, allowing investors to participate in potential massive value creation from the ground up. However, they require extensive due diligence and carry higher failure rates than established assets.

How do you identify and evaluate early-stage token opportunities?

Our process includes technical audits, team background checks, market analysis, token economics evaluation, and competitive positioning assessment. We leverage industry connections, attend conferences, and maintain relationships with incubators and accelerators to source opportunities early.

What is the typical holding period for early-stage token investments?

Holding periods typically range from 12-36 months, depending on project milestones, market conditions, and token unlock schedules. We may exit partially as projects mature or hold longer for exceptional performers with continued growth potential.